Alan Heath; Mortgage Broker Brisbane CBD

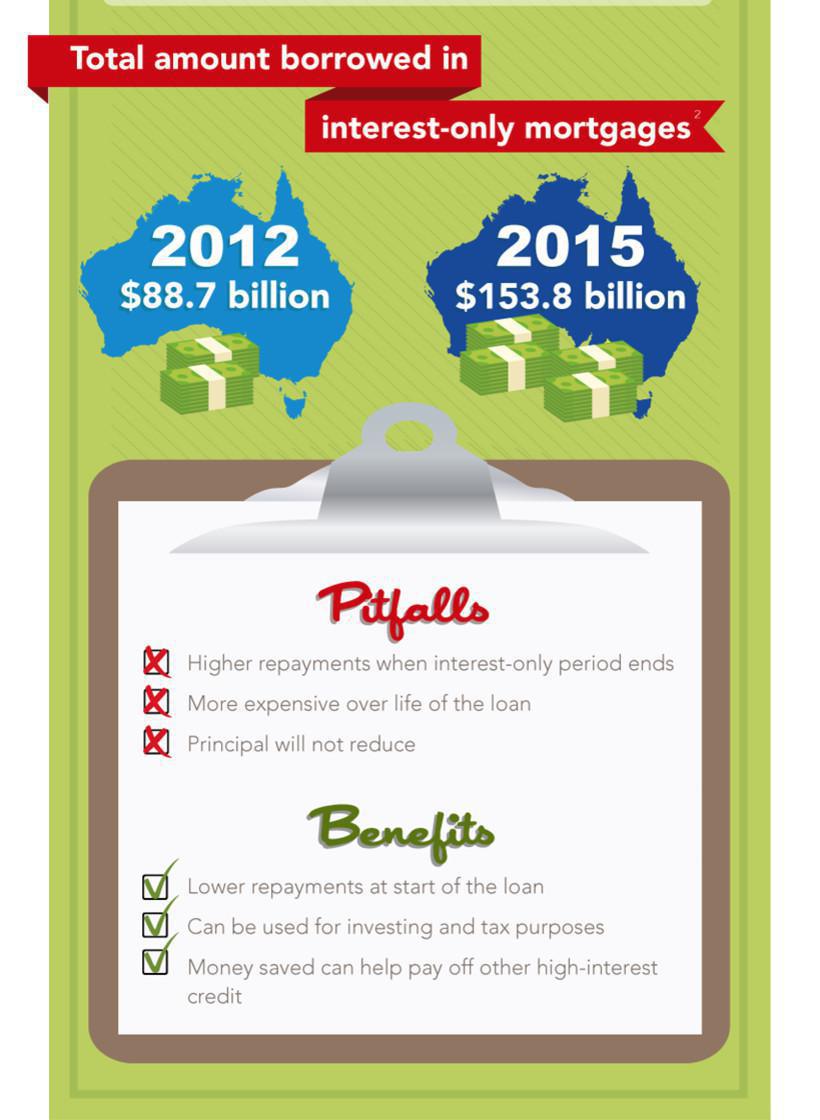

ASIC has taken an interest in the number of Interest Only loans being sold to owner occupiers

According to ASIC’s review of lenders in 2015, 25% of all owner occupied loans are Interest Only, 67% of investor loans are Interest Only.

Personally even I am surprised at the high number of Interest Only for owner occupiers.

The most appropriate loan for someone owning their own home is P&I (Principle and Interest) – why?

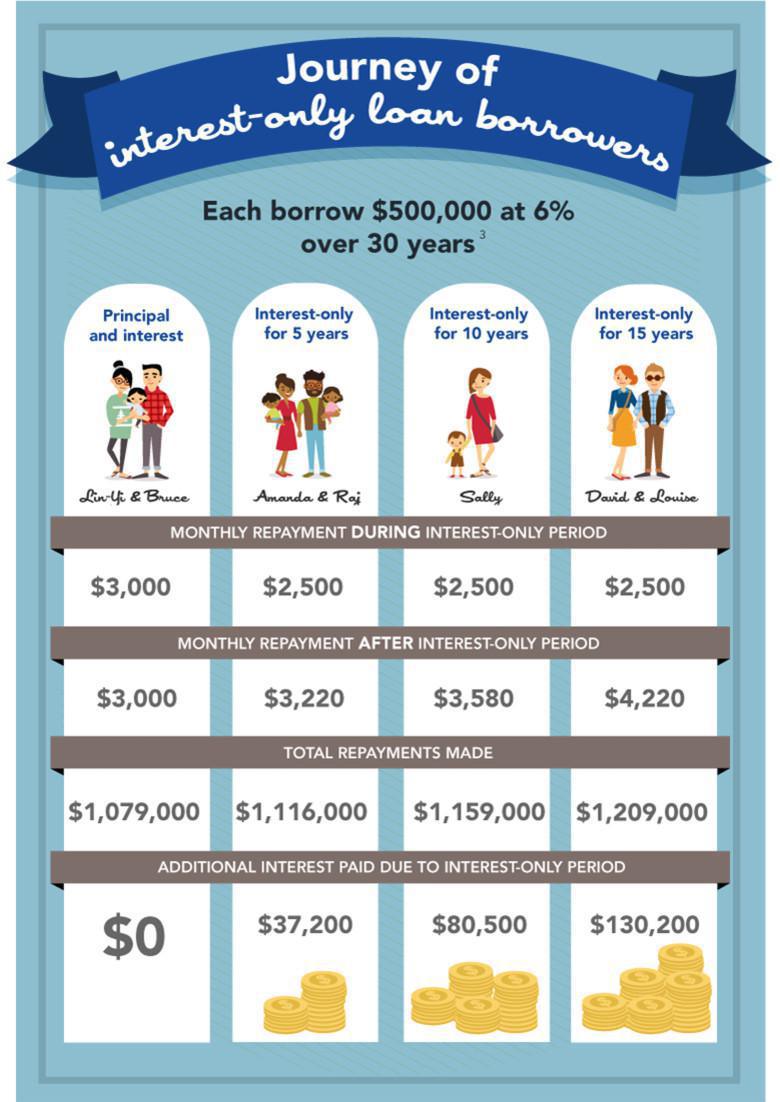

If you borrow (say $500,000) with a loan term of 30 years – then you need to pay the Principle back over 30 years, and Interest along the way (on the gradually reducing balance)

If you ask to have a “rest” from paying “P” , then obviously the payments if it is just “I” will be lower.

BUT …. The P ($500,000) must still be paid back in the 30 years. If you have a holiday from the P for 5 years, then when you come back to P&I then the P repayment component which now has to be paid back in 25 years will come as a surprise – because it will jump markedly

This is ASIC’s concern, that owner occupiers are finding ways to “afford” payments in the short term on a house that they really can’t afford.

I’m inclined to agree with them – in most cases people don’t realise that Interest Only loans have their payments jump markedly immediately after the Interest Only period ends

Interest Only loans really should be predominantly reserved for investors – where they have an owner occupied P&I loan and want to maximize the tax benefits on their investment loans